By submitting my E-mail address I confirm that I have study and accepted the Terms of Use and Declaration of Consent. In this post, I am going to walk you by means of the vital measures on how to set up a small business enterprise laptop or computer network. The amortization of the premium on these bonds is a miscellaneous itemized deduction not topic to the 2% limit. Enter ITA” in the search box on for the Interactive Tax Assistant, a tool that will ask you inquiries on a quantity of tax law topics and give answers. If you are asking for technical help, please be confident to consist of all your method information, like operating program, model number, and any other specifics connected to the trouble. Functioning from your home delivers a a lot more flexible schedule, much less overhead (minimal inventory), and extra manage more than what business comes your way. You can deduct particular lobbying expenses if they are ordinary and needed expenditures of carrying on your trade or business enterprise. See Publication 587 for a lot more detailed information and facts and a worksheet for figuring the deduction.

By submitting my E-mail address I confirm that I have study and accepted the Terms of Use and Declaration of Consent. In this post, I am going to walk you by means of the vital measures on how to set up a small business enterprise laptop or computer network. The amortization of the premium on these bonds is a miscellaneous itemized deduction not topic to the 2% limit. Enter ITA” in the search box on for the Interactive Tax Assistant, a tool that will ask you inquiries on a quantity of tax law topics and give answers. If you are asking for technical help, please be confident to consist of all your method information, like operating program, model number, and any other specifics connected to the trouble. Functioning from your home delivers a a lot more flexible schedule, much less overhead (minimal inventory), and extra manage more than what business comes your way. You can deduct particular lobbying expenses if they are ordinary and needed expenditures of carrying on your trade or business enterprise. See Publication 587 for a lot more detailed information and facts and a worksheet for figuring the deduction.

In order for you as a self-employed individual to deduct laptop-associated costs on Schedule C – whether for a household-primarily based laptop or one in a separate business enterprise location – it is needed that your costs relate to a profit-motivated business versus a hobby”.

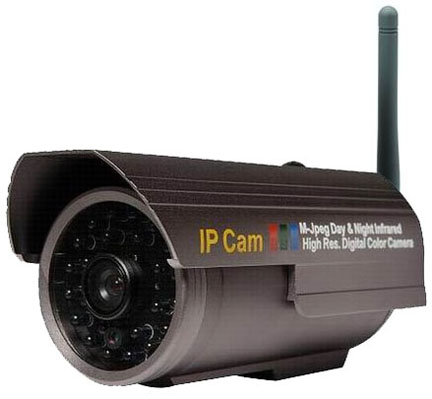

Setting up your network peer-to-peer only demands you to have a router (possibly with wireless capability) and the required Ethernet cords to run the router to the modem and from the router to all of your computer systems. You can normally deduct tax preparation fees on the return for the year in which you spend them. You can not deduct the expenses of lunches with co-workers, except even though traveling away from residence on enterprise.

My old computer is now operating like new and the repair was completed remotely – devoid of hauling the laptop or computer to a repair shop or opening my house to an unknown service individual. Of course I am thrilled to have found Mike and very advise his solutions for your laptop or computer troubles. See Publication 559 for facts about figuring the quantity of this deduction. This signifies that your use of the pc is for a substantial organization explanation of your employer.

Use Component V of Form 4562, Depreciation and Amortization, to claim the depreciation deduction for a computer system that you did not use only in your home workplace. You want to charge costs that are each very affordable to your consumers, but are also sufficient to retain your small business afloat. See Publication 970, Tax Rewards for Education, for a complete discussion of the deduction for perform-connected education expenditures.